It's hard to avoid news headlines of rising costs and environmental challenges we face as a global society. And you're ready to do your part to live a more efficient lifestyle while lowering your bills. One option you have to do both is to use the IRA (Inflation Reduction Act) tax credits and rebates. But where do you start, and how can you take advantage of it for your home? Read on to find out more.

Bringing the fight against climate change home

The IRA empowers you to make changes in your energy use. It was designed to help you invest in upgrades you may have considered before but felt were too expensive. And while we’ve seen energy-efficient savings programs in the past, the IRA provides value on a much bigger scale.

In the grand scheme of the clean energy economy, this is a big deal. “The residential sector is a really critical piece of the emissions reduction puzzle,” says Brandon Dyer, Sense’s Senior Manager of Regulatory Affairs. “In order to get the full value out of the IRA, residential customers really need to take action themselves.”

The IRA is a win-win: you can take advantage of the tax credits and rebates to upgrade your home and combat one of the largest contributors to climate change.

The IRA’s tax credits are already here

The two ways to benefit from the IRA are through rebates and tax credits. But at this time, only the tax credits are available, and they’re planned to be in effect for the next decade.

There are two main credits available for residential consumers:

- Energy Efficient Home Improvement Credit

- Residential Clean Energy Credit

While rebates focus on providing you with direct refunds, tax credits are designed to offset any taxes you might owe. The rules and requirements vary by credit, but the IRS created a comprehensive FAQ sheet to help you understand qualifications and how the credits work.

If you’re ready and eager to plan for your clean energy future, we’ve gathered a handful of moves you can make right now to ensure you’re getting the most out of every IRA benefit.

4 actions you can take to benefit from the IRA’s tax credits

Any cost-saving steps you take towards energy efficiency come with the bonus of making your home more enjoyable in the long run. The IRA helps you make those changes affordably, but it’s always good to know where to start and what makes the biggest impact. Looking to save money and energy? Start here.

Action #1 - Get an energy audit

On a base level, an energy audit lets you identify the least energy-efficient places in your home and plan accordingly. But it can be more than that. “An energy audit sets the stage for opportunities in the home,” says Dyer. “Some things you can fix with little or no cost. But it also helps a customer prioritize where spending the money might have the biggest impact on energy consumption or comfort or health and safety in the home.”

A professional audit shouldn’t cost more than $150. Many utilities will offer free audits for their customers — but it’s up to you to find out what’s available in your area. They may also offer enhanced incentives alongside an energy audit, such as rebates or no-money-down financing. Federal and state weatherization programs can even help you cover essential non-energy home repairs, clearing the way for you to then implement the energy efficiency solution. For example, fixing a leaky roof so you can add insulation to your attic.

You can prepare for an audit by listing any issues you’re already aware of. For example, any noticeable drafts or leaks, older appliances, or even months when your bills are higher than usual.

How you benefit

The home energy audit tax credit lets you claim 30% of the costs up to $150.

What to do

File the correct form and ensure that you use an auditor with the correct certifications and that you receive a report.

Action #2 - Weatherize

According to Dyer, weatherization isn’t just a good idea — it’s compulsory in cutting your home’s energy waste costs. “Weatherization is foundational,” he says, “and your home energy report will show you where to start.”

Weatherization actions include:

- Insulating your attic

- Adding weather stripping around doors and windows

- Fixing leaks in your HVAC ducts

- Investing in a water heater insulation blanket

- Upgrading windows and doors

- Installing a programmable or smart thermostat

How you benefit

The Energy Efficient Home Improvement Credit lets you claim a maximum of $1200 each year with:

- A limit of $250 per door, $500 total

- $600 limit for windows

- No limit beyond the $1200 for insulation and air sealing materials or systems

What to do

File the right form and ensure that you meet all requirements. Doors and windows must meet ENERGY STAR standards, and insulation and air sealing materials must meet International Energy Conservation Code (IECC) standards.

Action #3 - Upgrade your appliances, heating/cooling systems, and more

For now, you can focus on receiving tax credits for efficient heating and cooling systems, water heaters, and any other qualifying product listed by the IRS. However, be on the lookout for rebates that help you with the electrification in your home, including transitioning to energy-efficient washers and dryers.

How you benefit

Since this is also part of the Energy Efficient Home Improvement Credit, you receive up to $3200 in tax credits. This includes appliances to a max of $600 and heat pumps and biomass stoves, and boilers up to $2,000 per year.

What to do

Make sure that you meet all the requirements, and when filing taxes, fill out the right form.

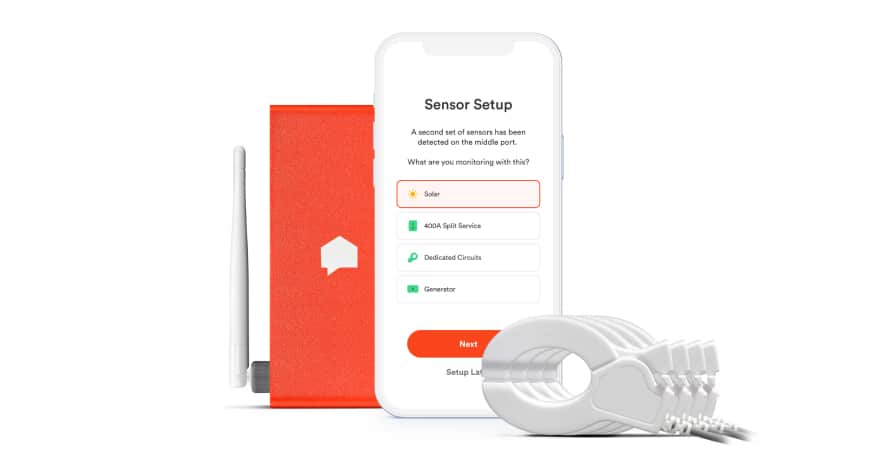

Action #4 - Invest in renewable energy upgrades

The Residential Clean Energy Credit lets you install renewable energy into your home while helping you save on the cost. The credit covers solar electric panels, solar water heaters, wind turbines, geothermal heat pumps, fuel cells, and battery storage technology.

How you benefit

You’ll save 30% on qualified renewable energy installation, including:

- Labor costs for onsite preparation

- Installation

- Piping or wiring to connect it to the home

- Equipment

The included labor and installation costs are a standout feature. It’s unique for federal dollars since other programs have only offered to cover the material cost of solar panels.

There is no limit, but the credit may not exceed what you owe. However, you can carry forward any unused credit for upgrades in the future.

What to do

Before investing, determine whether you meet all qualifications and requirements, and fill out the correct form at the time of filing your taxes.

Stay tuned for rebates

Right now, we’re all playing the waiting game when it comes to IRA rebates. They’re expected to land in late 2023, and each state will need to determine qualifications before the money starts flowing. But consumers can expect offerings like:

- Rebates for insulation, air sealing, and ventilation.

- Rebates for electric wiring upgrades.

- Rebates for ENERGY STAR certified electrification (converting to machines that use electrical power) equipment — such as washers, dryers, and heat pumps.

Everyone will benefit from IRA rebates, but if you have a lower income, you’ll save even more. Until the rebates arrive, you can take advantage of the numerous tax credits and any existing Federal rebates and incentives so you can begin reaping the rewards of a cost-and-energy-efficient home ASAP.

Even with all this information at hand, IRA benefits can still be hard to fully grasp. Luckily, every day brings new rebate and tax credit resources, in-depth guides, and other helpful tools to help you make the right choice for your household. For a great example, check out the Department of Energy’s (DOE) Energy Savings Hub. And make sure to keep an eye out for new resources about the IRA — and more — from us.